Maybe not, but what if: In the event of a recession, a tens of percent gap opens up for US stocks

Is the US heading into a recession? Economists disagree, of course, but in recent weeks they have tended to look for a smooth economic landing. But the dynamics of some economic indicators and the long-term and pronounced inversion of the US government bond yield curve warn against too much optimism. The stock market in America has held up reasonably well this year despite the latest pullback, but how could a possible recession shake it up?

History offers many examples of recessions and deep stock market declines. Of course, history never repeats itself exactly, but investor sentiment in similar economic conditions is often also very similar, as is the course of various price corrections and bear markets.

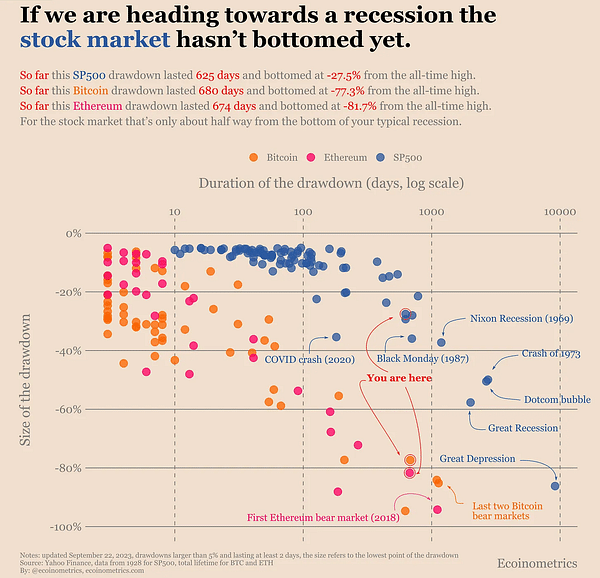

The all-time highs in the S&P 500 index are now almost two years old. Since then, the market has seen a maximum decline of 27.5% so far, relatively modest for a bear trend. When recessions have broken out in the US in the past (recall that in America they do not take into account the definition of a recession used in Europe as two quarterly GDP declines in a row; recessions are declared on the basis of multiple indicators by the NBER, the National Bureau of Economic Research), the declines in stock prices have generally been deeper. And significantly so.

Great Depression: -86%

Great Recession: -58%

Internet bubble (Dot.com): -50%

The 1973 crash: -50%

Recession under President Nixon in 1969: -37%

Black Monday in 1987: -36%

Covid-19 pandemic: -35%

Declines of 50% were not common in the past, but they did occur. Declines of more than 30% were then quite common. While the present is of course different from the past in many ways, based on long-term market experience, it cannot be ruled out that US equities have not yet bottomed out in the current bear trend, which was triggered by the decline from the S&P 500 Index high of January 2022.

The Stock Market Almanac says further declines are very possible. All it would take is a small thing, namely for the NBER to declare a recession. Rates are high, liquidity in the financial system is dwindling (the Fed continues to withdraw $95 billion per month from the market), and the geopolitical situation is quite tense. Incidentally, a 50% drop from the highs would return the S&P 500 index to roughly the 2,400 point level, the lows of the flash pandemic in the markets.

Very interesting information and an interesting chart. I currently have no idea if a recession is coming or not, but thank you for this post :D

I'm quite intrigued too :) You're welcome.

Interesting summary :) anyway, I have absolutely no idea if a recession is coming or not :D

Believe me, no one... :-D

Some say they know :D

Believe me, no one... :-D

It doesn't look like a recession yet, but what isn't may be. Then it would be really wild, but it would be the opportunity of a lifetime.

Life opportunities sound very good to me... just don't miss them again! :)

It's interesting, unfortunately in the current situation I can't judge what direction the market will take. What do you think is the best strategy right now?

Honestly now I can probably only describe in an alibi way what I wouldn't do rather than what I would do... :)

I'm overbuying undervalued dividend stocks in the current situation.